When Properties Don’t Need an Energy Performance Certificate

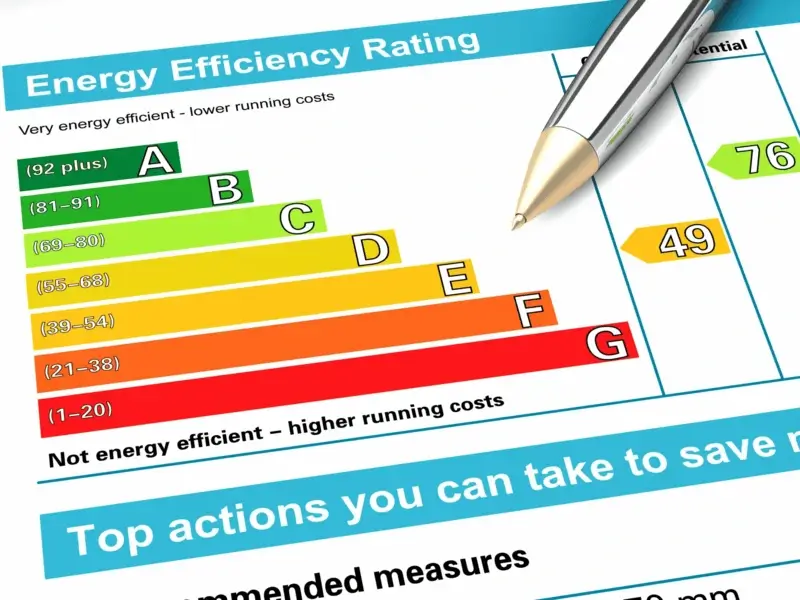

Most buildings in the UK need an Energy Performance Certificate (EPC) before being sold or let. But there are exceptions. In certain cases, your building may be legally exempt from requiring an EPC at all. Learn more in our full EPC guide.

In this post, we’ll explain what qualifies as an EPC exemption for both residential and commercial buildings, how to check if you’re eligible, what documentation may be needed, and the risks of claiming an exemption incorrectly.

What Is an EPC Exemption?

An EPC exemption means you’re not legally required to obtain a certificate for a specific building — usually due to its use, structure, or protected status. These exemptions apply across both residential and commercial sectors but differ slightly depending on the building type.

Residential EPC Exemptions (Domestic Buildings)

Most homes need an EPC when sold or rented out, but exemptions apply in specific situations:

- Listed buildings where energy upgrades (e.g. double glazing) would unacceptably alter the building’s character.

- Temporary homes intended for use over a period of two years or less.

- Holiday homes used for less than four months annually, or with minimal expected energy use.

- Detached buildings under 50 m² in total internal area.

- Short lets under six months with no renewal rights.

- Homes scheduled for demolition, with approved planning permissions and vacant possession.

Each case requires careful consideration. For example, not all listed buildings are exempt — only those where improvements would impact heritage features.

Commercial EPC Exemptions (Non-Domestic Buildings)

Non-domestic premises also have defined exemption scenarios, including: See our commercial EPC breakdown.

- Buildings with no fixed heating, cooling, or mechanical ventilation systems (such as empty shells or unheated warehouses).

- Listed or protected buildings where energy improvements would damage historic integrity.

- Temporary buildings in use for two years or less.

- Places of worship used solely for religious activities.

- Low-energy agricultural or industrial buildings, such as barns or basic workshops.

- Detached buildings under 50 m² total floor space.

- Buildings due for demolition, where all necessary planning consents are in place.

As with domestic buildings, documentation is required to support these exemptions if challenged.

How to Check If You Qualify

To determine whether your building qualifies for an exemption, consider its legal status, design, and usage. For example, if your property is listed or located in a conservation area, check with your local council or Historic England to confirm its status. If it’s used seasonally or temporarily, review your lease agreements, occupancy records, or energy usage history. For detached buildings, measure the internal floor space — if it’s under 50 m² and self-contained, it may qualify.

In demolition cases, ensure you have planning approval in place and can demonstrate the building is being sold or let with vacant possession. For non-domestic units with no services installed, a lack of heating, cooling, or ventilation may be sufficient — but it’s best to confirm with an assessor.

In all cases, evidence is essential. You should be able to justify the exemption if questioned.

What Documents Might Be Needed?

If you’re claiming an exemption, it’s important to have supporting documentation. Depending on your scenario, this might include:

- Planning permission or consent to demolish

- Proof of listed status or protected designation

- Short-term lease agreements for lets under six months

- Floor plans confirming a building is detached and under 50 m²

- Booking logs or utility bills for seasonal holiday use

- Confirmation that no heating or air conditioning systems are present

If you’re a landlord using a MEES exemption, you’ll also need to register it on the PRS Exemptions Register and upload your evidence. For guidance, see our post on 2025 EPC rules.

What Happens If You Claim an Exemption Incorrectly?

If you’re a landlord using a MEES exemption, you’ll also need to register it on the PRS Exemptions Register and upload your evidence.

Falsely claiming an exemption can lead to penalties of up to £5,000 per building. Local authorities are empowered to fine landlords, sellers, or agents who market a building without a required EPC. Even if an EPC isn’t produced, a breach still exists — and a certificate may still be required after the fact. Learn how long EPCs last and when to renew.

Claiming incorrectly also increases the risk of sale or letting delays, enforcement notices, and reputational damage. If in doubt, it’s always safer to get an EPC or consult a qualified assessor before assuming you’re exempt.

Final Thoughts

Not every building needs an EPC — but the exemptions are precise and legally defined. Whether you’re dealing with a holiday cottage, a heritage property, or a site set for demolition, always verify the rules and prepare the right documents.

Need an EPC? Our network of qualified, independent energy assessors handle both domestic and commercial EPCs. Visit the Areas We Cover page to find your local assessor.